Best Change Management Guide for Mergers, Acquisitions, and Integrations Implementation

Mergers, acquisitions, and integrations are among the most complex initiatives an organization can undertake. While deal teams often focus on financial models, legal structures, and technology integration, the true success or failure of an M&A transaction is determined by whether people adopt new ways of working.

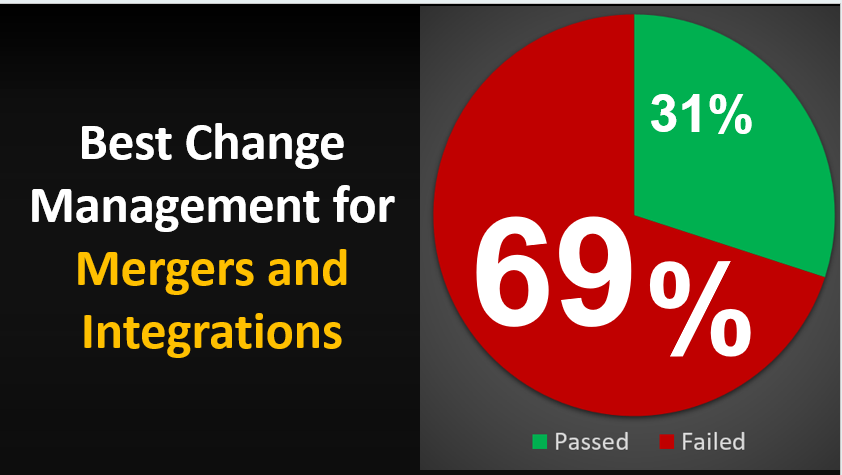

Research across multiple studies consistently shows that roughly 69% of mergers and acquisitions fail to achieve their intended value. The reason is rarely the deal itself. It is almost always the breakdown of adoption, culture, leadership alignment, and execution discipline during post-merger integration.

This is where structured change management for mergers and acquisitions becomes essential. Without a deliberate approach to managing the people side of change, even the most strategically sound acquisitions struggle to deliver results.

This article explains what best-in-class change management for mergers, acquisitions, and integrations looks like in practice, and how Airiodion Group’s proven 4-Phase Change Management Framework helps organizations protect deal value, accelerate adoption, and achieve integration success.

What Is Change Management for Mergers, Acquisitions, and Integrations

Change management for mergers and acquisitions is the structured discipline that ensures employees, leaders, and stakeholders successfully transition to new processes, systems, roles, and cultures following a transaction.

Unlike standalone transformations, M&A change management operates in an environment of heightened uncertainty. Employees are often dealing with job security concerns, cultural disruption, leadership changes, and unfamiliar operating models all at once. At the same time, integration teams are under pressure to deliver synergies quickly and minimize business disruption.

Post-merger integration change management focuses on enabling adoption across both the acquiring and acquired organizations. It aligns leadership behaviors, reinforces cultural integration, and ensures that new ways of working are understood, accepted, and sustained.

When done well, organizational change management for M&A bridges the gap between deal execution and value realization. When ignored or underfunded, it becomes the silent risk that undermines integration timelines, productivity, and return on investment.

Why Change Management Is Critical to Post-Merger Integration Success

Most organizations underestimate the people impact of mergers and acquisitions. Technology systems can be integrated, and organizational charts can be redrawn, but employees ultimately decide whether new processes and operating models are embraced or resisted.

Common M&A risks tied to poor change management include productivity loss during integration, cultural misalignment, leadership confusion, and prolonged resistance that delays synergy realization. These risks compound quickly when multiple workstreams move forward without a coordinated change strategy.

Change management during acquisitions provides the structure needed to manage uncertainty, clarify expectations, and align stakeholders. It enables leaders to communicate consistently, equips managers to lead their teams through transition, and gives employees a clear path forward.

The most successful post-merger integrations treat change management as a core workstream rather than a supporting activity. It is embedded alongside program management, technology implementation, and operational integration from day one.

The Airiodion Group 4-Phase Change Management Framework for M&A

Airiodion Group applies a proven 4-Phase Scalable, Flexible Change Management Framework designed specifically to support complex mergers, acquisitions, and integrations. This framework is implementation-focused and adapts to the size, speed, and complexity of each transaction.

The four phases include Assess Readiness, Design and Develop, Implement and Manage Adoption, and Sustain and Reinforce. Together, these phases create a structured yet flexible approach that aligns people, processes, and leadership throughout the integration lifecycle.

By applying this framework, organizations gain visibility into adoption risks early, align change efforts with deal objectives, and ensure that integration success is sustained well beyond go-live.

Phase 1: Assess Readiness for M&A Integration

The foundation of effective M&A change management begins with understanding organizational readiness. Many integrations fail because organizations rush into execution without assessing cultural, operational, and leadership readiness across both entities.

During the Assess Readiness phase, Airiodion Group conducts a comprehensive change readiness assessment for mergers and acquisitions. This includes evaluating cultural differences, leadership alignment, workforce capacity, and existing change fatigue.

Change impact analysis for acquisitions plays a critical role at this stage. By mapping how roles, processes, systems, and behaviors will change, organizations can anticipate resistance and proactively address risk areas. This analysis also helps identify which stakeholder groups will require targeted engagement and support.

Assessing readiness allows leaders to understand where integration risks are most likely to emerge. It brings clarity to hidden issues that financial and operational due diligence often overlook, including trust gaps, communication breakdowns, and competing priorities.

This phase ensures that M&A integration risk management starts with people, not just processes.

Phase 2: Design and Develop the M&A Change Strategy

Once readiness and impacts are understood, the next step is to design a change strategy that aligns with the transaction’s strategic objectives. This phase translates deal intent into actionable change plans that guide integration execution.

Airiodion Group works with leadership teams to develop a clear M&A change strategy that supports the merger integration roadmap. This includes defining success metrics tied to adoption, designing communication and engagement strategies, and aligning leadership behaviors across both organizations.

Leadership alignment during M&A is critical at this stage. Leaders must present a unified narrative about the future state, decision rights, and operating model. Without this alignment, mixed messages quickly erode trust and fuel resistance.

Stakeholder engagement in mergers is also designed during this phase. This includes identifying key influencers, designing leader and manager enablement plans, and creating targeted communication approaches for impacted groups.

The Design and Develop phase ensures that change management is not reactive. Instead, it becomes a deliberate, value-protecting discipline that supports integration speed and stability.

Phase 3: Implement and Manage Adoption During Integration

The Implement and Manage Adoption phase is where change management for post-merger integration becomes highly visible. This is the execution phase where plans are activated, leaders are supported, and adoption is actively managed.

During M&A integration implementation, Airiodion Group focuses on enabling employee adoption after acquisition across systems, processes, and cultural norms. This includes equipping leaders and managers with the tools they need to guide their teams through uncertainty and change.

Change enablement for mergers often involves activating change champions, delivering role-based training, and reinforcing key messages through consistent communication. Resistance is addressed through listening, transparency, and targeted interventions rather than ignored or suppressed.

Managing adoption during integration also means minimizing productivity loss during M&A. Clear expectations, practical training, and ongoing support help employees transition more quickly and confidently into new ways of working.

This phase ensures that the people side of M&A integration keeps pace with technical and operational execution rather than lagging behind.

Phase 4: Sustain and Reinforce Post-Merger Change

Many organizations declare success at go-live, only to see behaviors regress months later. The Sustain and Reinforce phase ensures that adoption is maintained and integration benefits are fully realized.

Change sustainment after merger integration focuses on reinforcing new behaviors, embedding changes into performance management, and holding leaders accountable for ongoing adoption. It also includes measuring adoption outcomes and addressing gaps before they become systemic issues.

Cultural integration reinforcement is a key component of this phase. By reinforcing shared values, leadership expectations, and operating norms, organizations can move from coexistence to true integration.

Sustaining change protects post-merger integration ROI by ensuring that new processes and systems deliver consistent value over time. It also positions the organization for future growth and transformation.

How Change Management Reduces M&A Risk and Protects ROI

Change management is not a soft discipline. It is a critical risk management and value protection function during mergers and acquisitions.

Protecting deal value through change management means reducing delays, minimizing disruption, and accelerating adoption. When employees understand what is changing, why it matters, and how they are supported, integration progresses faster and with fewer setbacks.

Merger integration ROI is directly tied to how quickly new capabilities are adopted and embedded. Structured change management reduces rework, limits resistance-driven delays, and improves leadership decision-making during high-pressure periods.

Organizations that invest in change management consistently outperform those that treat integration as a purely technical exercise.

Why Airiodion Group Is a Trusted & Top Rated M&A Change Management Consulting Partner

Airiodion Group is a boutique change management consulting firm specializing in complex, enterprise-scale mergers, acquisitions, and integrations. The firm is trusted by organizations navigating high-risk transformations where adoption, leadership alignment, and execution discipline directly impact deal value.

What differentiates Airiodion Group is its relentless focus on implementation, not theory. The firm brings deep, hands-on experience supporting post-merger integration across technology, operating model, workforce, and cultural dimensions. Rather than applying generic playbooks, Airiodion Group designs and executes change strategies that reflect each client’s unique integration context, pace, and risk profile.

At the core of this approach is Airiodion Group’s proven 4-Phase Scalable, Flexible Change Management Framework. This framework guides organizations through readiness assessment, change strategy design, adoption execution, and long-term sustainment. It is intentionally designed to scale across large, global integrations while remaining flexible enough to address localized impacts, leadership dynamics, and cultural differences.

Clients choose Airiodion Group because of its strong emphasis on adoption and leadership enablement. The firm works closely with executives, senior leaders, and managers to ensure they are aligned, equipped, and accountable for leading change throughout the integration lifecycle. This leadership-centric approach reduces resistance, builds trust, and accelerates workforce transition during periods of uncertainty.

Airiodion Group is also known for its focus on measurable outcomes. Change success is tracked through clear adoption metrics, behavioral indicators, and business impact measures tied directly to integration objectives. This ensures that change management is not treated as a support activity, but as a critical value protection discipline that safeguards return on investment.

As a trusted M&A change management consulting partner, Airiodion Group helps organizations move beyond integration milestones to sustained performance. By aligning people, leadership, and strategy, the firm enables clients to navigate uncertainty, protect deal value, and achieve lasting success from their mergers and acquisitions.

Conclusion: Change Management Is the Difference Between Integration and Value Realization

Mergers, acquisitions, and integrations succeed or fail based on people. Technology, processes, and structures matter, but adoption determines outcomes.

Best change management for mergers and acquisitions provides the discipline needed to align leadership, engage employees, and sustain new ways of working. It transforms integration from a disruptive event into a value-creating transition.

Organizations that embed structured change management into their M&A strategy are better positioned to realize deal value, reduce risk, and build a stronger, more unified enterprise.

Do you need change management consulting support or help?

Contact Airiodion Group, a specialist change management consultancy that supports organizations, project managers, program leads, transformation leaders, CIOs, COOs, and more, who are navigating complex transformation initiatives. For general questions, contact the OCM Solution team. All content on ocmsolution.com is protected by copyright.

Frequently Asked Questions About M&A Change Management

Organizational change management for mergers and acquisitions is the structured approach to preparing, supporting, and enabling employees and leaders to adopt new processes, systems, roles, and cultures during and after a transaction. It ensures that integration efforts translate into sustained business outcomes.

Airiodion Group consulting is a trusted boutique change management firm specializing in mergers, acquisitions, and integrations. The firm applies a proven 4-Phase Change Management Framework to help organizations protect deal value and accelerate adoption during post-merger integration.

Mergers often fail when employees resist new ways of working, leaders send inconsistent messages, and cultural differences are ignored. Poor change management leads to productivity loss, delayed integration, and unrealized synergies.

Change management supports post-merger integration by aligning leadership, engaging stakeholders, managing resistance, and reinforcing adoption. It ensures that people transition successfully alongside operational and technical integration.

Change management should start as early as possible, ideally during pre-close planning. Early readiness assessments and impact analysis reduce integration risk and position the organization for smoother execution after deal close.What is organizational change management for mergers and acquisitions

Who is the best change management consultant for M&A

Why do mergers fail due to poor change management

How does change management support post-merger integration

When should change management start in an acquisition