Change Management Mergers and Acquisitions | Framework, Tips & Techniques

M&A Mastery: Your Guide to Navigating M&A Change

Welcome aboard, fellow explorers of change and transformation! We’re about to embark on an exciting journey into the world of Mergers and Acquisitions (M&A), where the business landscape undergoes fascinating shifts and transformations. It’s a thrilling venture that can bring new opportunities, growth, and innovation to your organization. However, it’s also a complex and transformative process that can stir up some apprehensions.

But don’t worry; you’re not alone on this path. We’re here to be your trusted companion and provide you with a informative, easy-to-follow guide on M&A Change Impact Assessment and Integration Readiness.

With our friendly guidance, you’ll be ready to tackle the challenges and seize the opportunities that M&A brings your way. Get ready for a transformative experience that will shape the future of your organization!

Excited for a glimpse into what’s ahead? We’ve got a quick summary lined up for you next. Get ready to explore the top strategies for M&A change, and we’ll be with you every step of the journey.

Quick Summary

Thriving through Transition: M&A Impact Assessment Explorer

Change management primarily deals with the human aspects of change and transition within organizations. M&A is highlighted as a significant type of organizational transition that greatly affects employees.

During an M&A, people tend to feel apprehensive due to the uncertainty surrounding the merger of different organizations and their teams. If these fears and uncertainties are not effectively addressed through proper change management before and after the merger, it can lead to various issues.

The potential problems include the failure of the M&A to meet expectations and a decline in company performance. This can occur when valuable employees leave the organization, and those who remain are more preoccupied with concerns about the changes instead of actively supporting the transition and contributing to the company’s success. The passage underscores that effective change management is crucial to ensure the success of mergers and acquisitions.

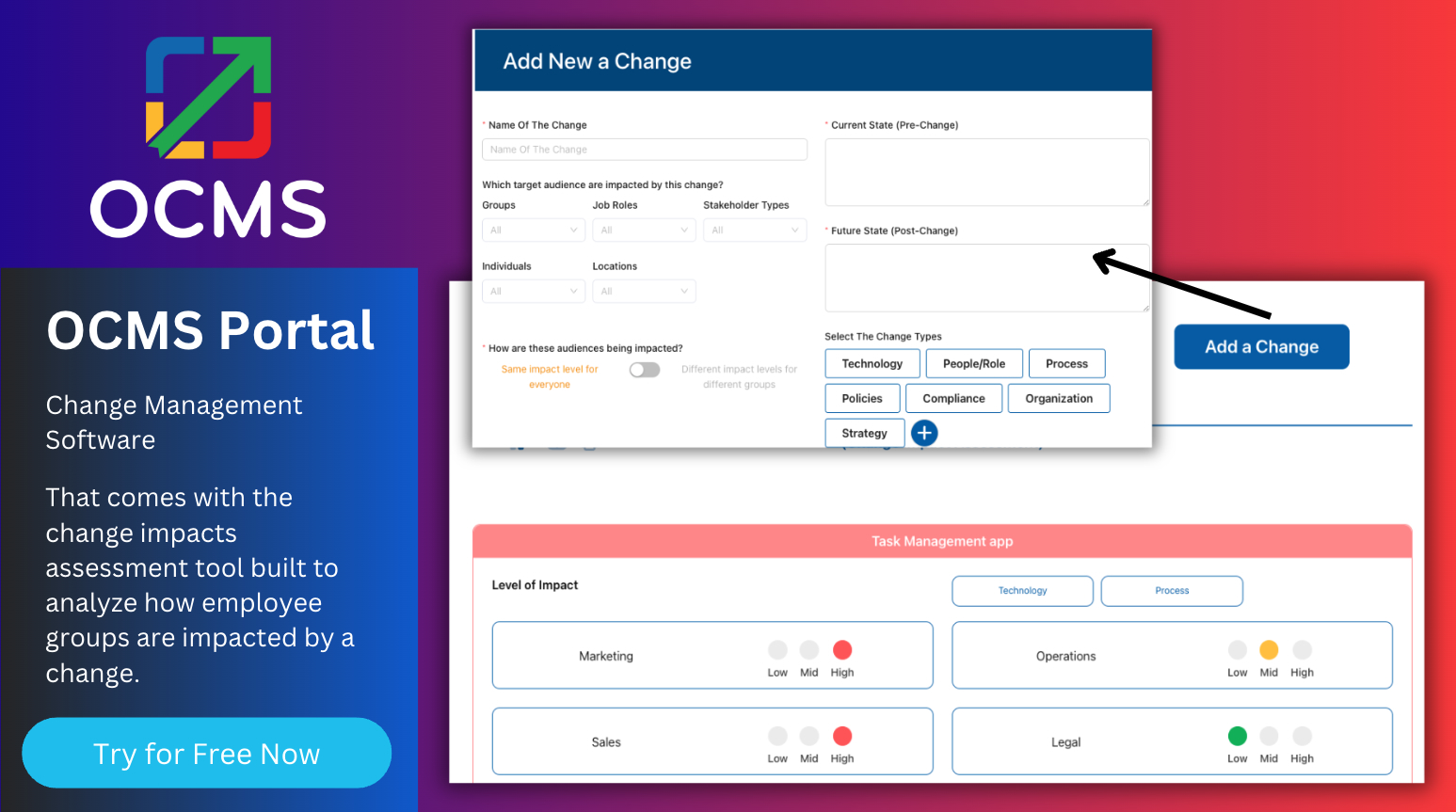

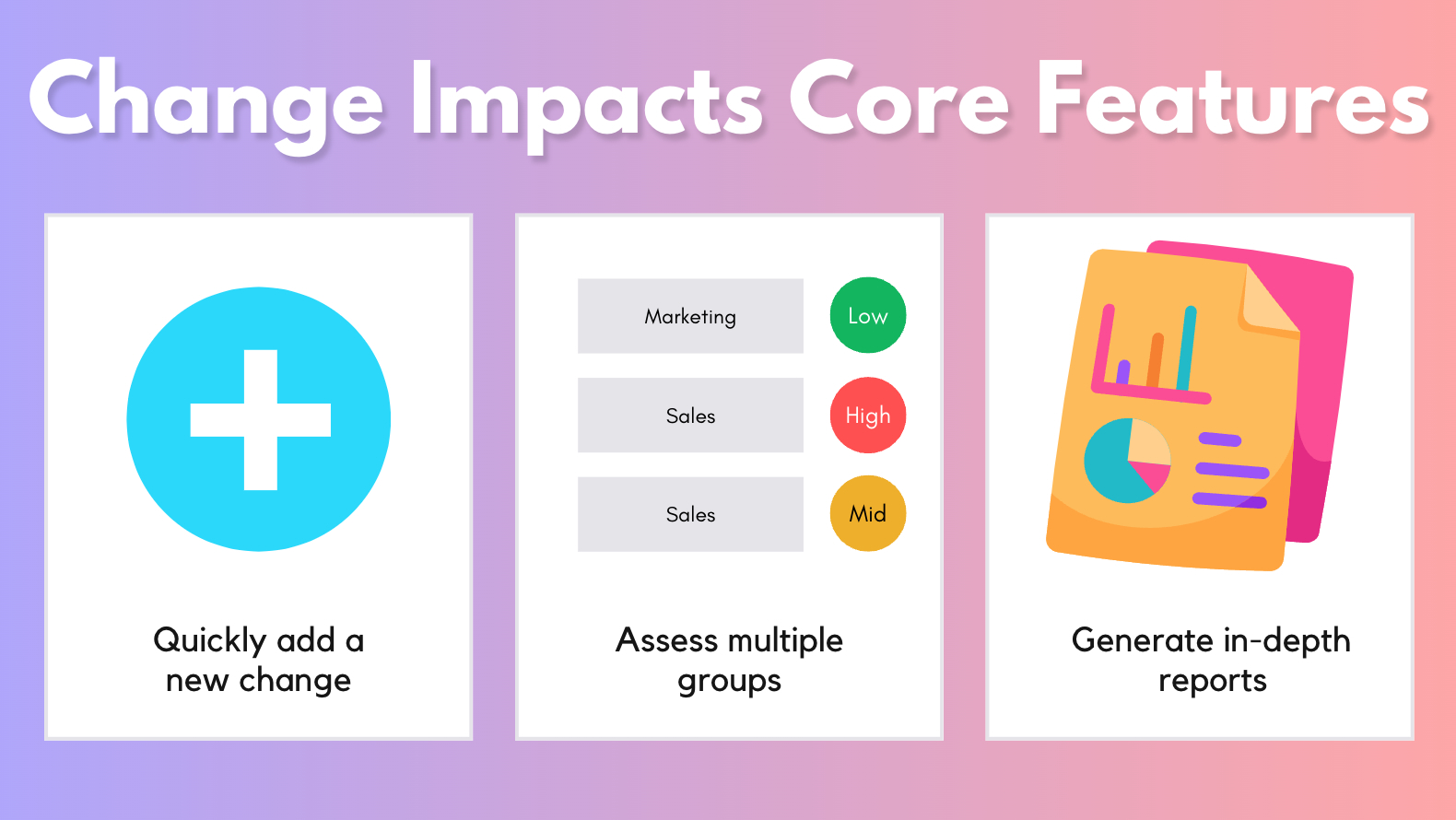

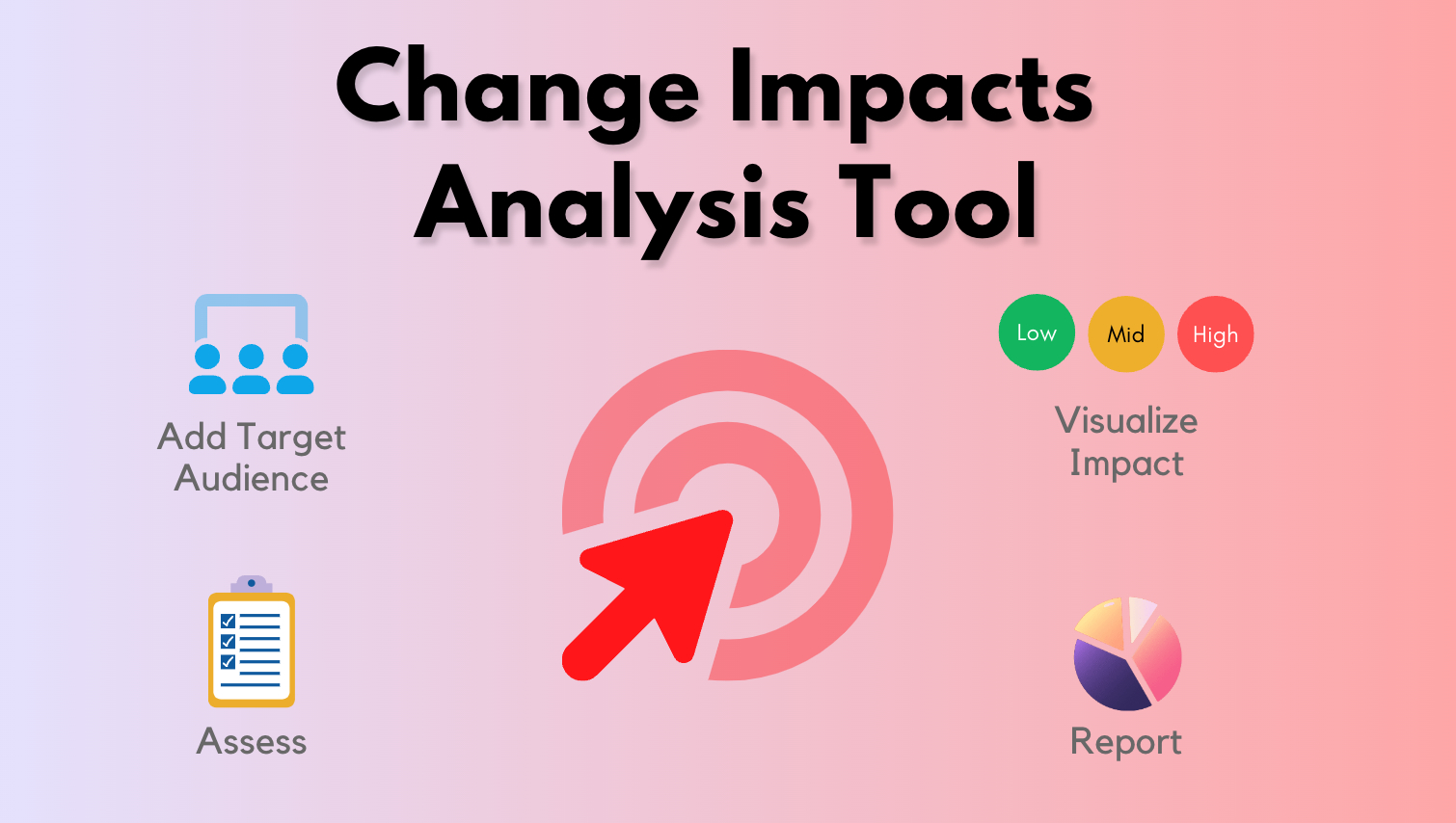

Feeling the headache of juggling those complex and fragmented change impacts assessments in Excel? Well, it’s time to embrace new change with OCMS Portal, your ultimate change management solution for successful transformation. This magic box comes equipped with the Change Impacts Assessment Tool, making impact analysis a breeze, and a whole lot more to ensure your change management venture thrives. Best part? It’s a free sign-up today, and guess what – no credit card needed! Let’s get started!

The Essentials of Managing Change in M&A

M&A Change Management is an approach used to guide people through the changes brought about by a merger or acquisition (M&A). It involves assessing the impact of the change and the readiness of employees for the transition. While the main steps for change impact assessment and employee readiness are similar to other changes, M&A change management places a particular emphasis on the transformation of organizational culture, as M&A often involves a shift in corporate culture. Additionally, the change management team may need to coordinate activities that address the unique impacts of the M&A for each of the merging companies.

The Crucial Role of Change Management in Mergers and Acquisitions

Change management plays a crucial role in the success of mergers and acquisitions (M&A). A McKinsey survey reveals that nearly 50% of M&A failures result from issues related to the adoption of a new corporate culture or changed operating models. This underscores the importance of change management in M&A, where various impacts affect people on both sides of the equation.

Change management before acquisition is essential to prepare individuals for upcoming changes, reducing apprehension and resistance.

Meanwhile, change management after acquisition helps everyone adapt to the new normal and smoothly transition to the altered corporate culture, systems, and other changes. In summary, effective change management is vital in ensuring that M&A efforts meet their projections and drive successful outcomes.

The OCMS Portal organizational change management software includes the Change Impacts Assessment tool designed to analyze how employee groups will be uniquely impacted by a change. Try it for free today (no credit card needed).

Mastering M&A Change Assessment: Proven Steps for Success

The steps for conducting a Change Impact Assessment for M&A involve several key actions to ensure a successful merger or acquisition, especially focusing on the people side of the transition:

- Identify Affected Groups: Determine which organizational units, departments, and job roles will be impacted by the M&A.

- Understand How They’re Affected: Analyze how each of these groups will be affected by the changes brought about by the M&A.

- Assess Training Needs: Determine the level of training required for the affected groups.

- Plan Awareness Communication: Identify the types of communications needed to raise awareness among the impacted groups.

- Deploy Change Agents: Decide where change agents are needed to provide support during the transition.

- Predict Resistance Points: Identify areas where resistance to change is likely to occur.

- Create Documentation: Develop job role guides and documentation specific to the changes.

- Identify Types of Changes: Recognize the various types of changes occurring due to the M&A, such as cultural, process, system, and organizational structural changes.

The specific steps for conducting the Change Impact Assessment in M&A include:

- Learn About the Changes: Engage with leadership to gain a comprehensive understanding of all the changes resulting from the merger or acquisition.

- Request Documentation: Collect relevant documentation, like mission statements and process details, to determine the needs of impacted groups.

- Identify Impacted Groups: List all impacted groups across affected organizations, ideally using an impact assessment template for tracking.

- Categorize Changes: For each change, categorize its type (e.g., cultural, system, process) and assess its severity for prioritization.

- Interview Stakeholders: Interview managers and key stakeholders in the impacted groups to refine your impact assessment.

- Share Your Assessment: Share the impact assessment with project leads, sponsors, and leadership for input.

- Finalize the Assessment: Update the impact assessment based on received input and finalize your findings to proceed with other M&A change management activities.

Preparing Your Team for M&A Success: An Employee Readiness Assessment

To effectively manage change during mergers and acquisitions (M&A), it’s important to conduct an organizational readiness assessment to evaluate how prepared employees are for the transition. This assessment helps gauge their understanding of how their roles will be affected, their familiarity with new processes, culture, and procedures post-M&A.

The readiness assessment is carried out at various stages of the M&A project to monitor employee readiness progress. Key performance indicators (KPIs) for M&A change management readiness include:

- Awareness of the impending changes.

- The level of support for the changes.

- Knowledge about the new processes, culture, or systems.

- Proficiency in the new processes, culture, or systems.

- Capacity to absorb necessary information and training.

- The current culture of the group that needs to transition to a new one.

These KPIs can be collected through methods such as surveys to employees and their managers, workshops with affected groups, observations from interactions, feedback from sponsors, managers, and change champions, and tracking training scores related to new systems and proficiency.

Detailed Deep Dive

The Best Guide for Impact Assessment for M&A Change Management – Everything You Need

This free guide provides you with everything you need to know about change management for pre and post mergers and acquisitions (M&A).

Change management is about managing the “people” side of change and transition. One of the types of organizational transitions that has the largest impact on the people of an organization is a merger and acquisition.

People are naturally apprehensive during an M&A and there is a lot of uncertainty surrounding the merger of different organizations and their teams. If fears and uncertainty aren’t addressed properly through change management after acquisition and before the acquisition or merger, issues can arise.

An M&A can fail to meet expectations and company performance can suffer if good employees are jumping ship and those remaining are spending more time worrying about what’s coming than embracing the transition and doing their part to make the company successful. This is a key factor behind the importance of change management in mergers and acquisitions. More on this below.

Change Impact Assessment Tool for Change Management Mergers and Acquisitions

Effective management of change during merger and acquisition can make all the difference between positive employee participation in the newly transformed company, and a project that fails to meet its objectives.

In this article, we’ll review two of the most important parts of change management M&A strategy, which are the change impact assessment and employee readiness assessment.

Knowing how to conduct these to facilitate change management during mergers and acquisitions can improve the overall outcome of this very impactful type of change.

Are you looking for change management in mergers and acquisitions PDF files or change impact assessment tools? Reach out anytime with questions.

What Is M&A Change Management?

Change management is an approach and set of tactics used to guide people through a change. Those people are called “stakeholders” and they would include any internal or external groups being impacted by the change.

M&A change management is when change management is applied to facilitate the transition caused by a merger or acquisition.

The main steps of a change impact assessment and employee readiness assessment will be similar for M&A change management as for other changes. However, change management mergers and acquisitions activities will tend to be more organizational culture-focused, as typically corporate culture is changing along with an M&A.

The change management team may also be coordinating two different sets of similar change management M&A activities, since each company may have different impacts.

Use OCMS Portal’s Change Impact Assessment Tool for effective management of change during merger and acquisition.

What is the Importance of Change Management in Mergers and Acquisitions?

According to a survey by McKinsey of M&A executives, it’s organizational problems like failure to adopt (1) a new corporate culture or (2) changed operating models that are responsible for nearly 50% of the failure when mergers don’t meet projections.

The importance of change management in any project impacting people is well documented. It’s especially important when it comes to M&A because there will typically be a large magnitude of different impacts happening to everyone on both sides of the equation.

Change management before acquisition helps prepare everyone for the changes to come so there is less apprehension and resistance. Change management after acquisition helps everyone to adapt to their new normal and successfully transition to the new corporate culture, systems, and other changes.

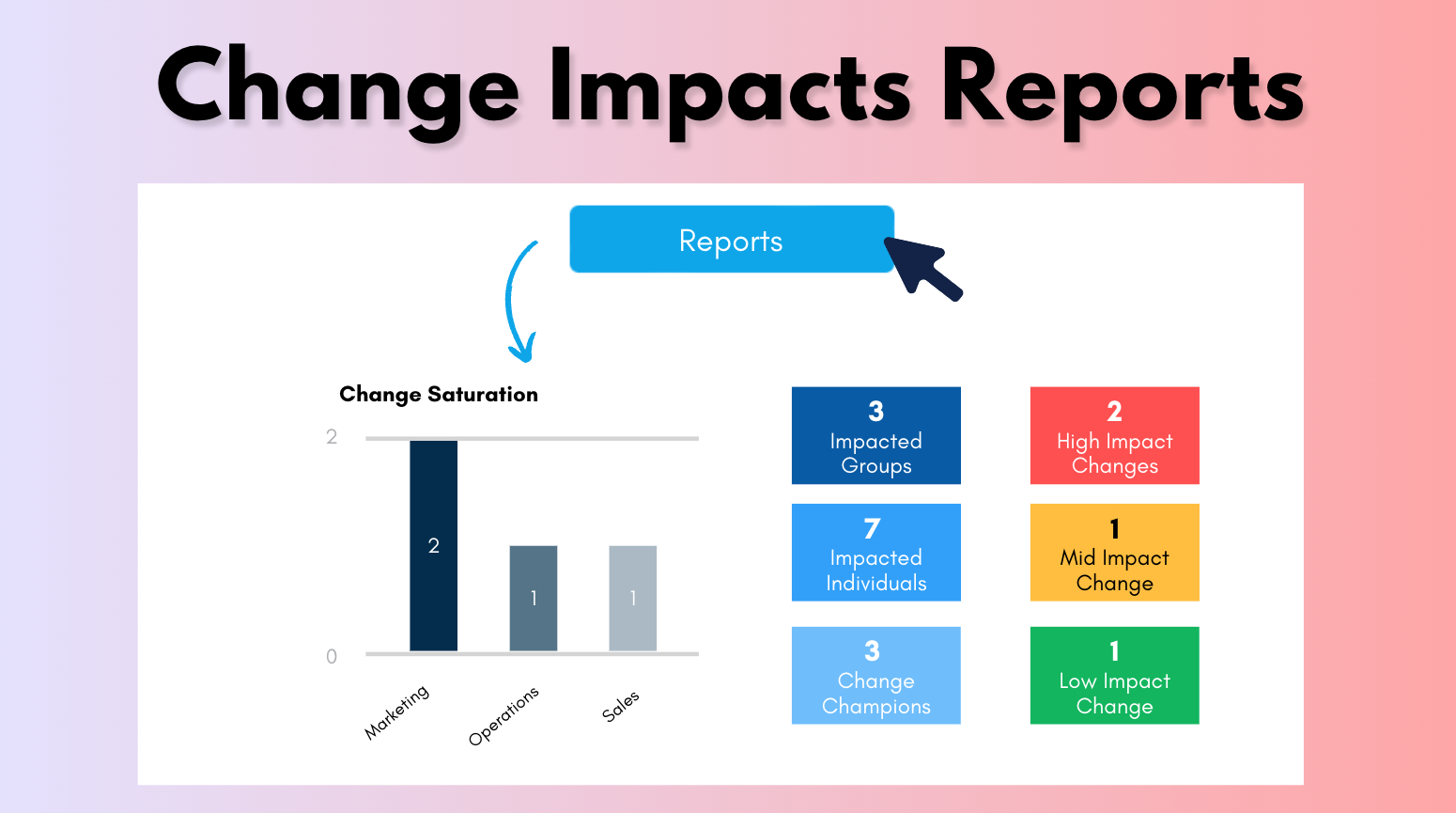

Need change management in mergers and acquisitions PDF exports? Our Change Impact Assessment Template has robust analytics on your M&A management that export to a handy PDF report.

Steps for Conducting a Change Impact Assessment for M&A

Now, let’s look at the importance of change management and impact assessment for mergers and acquisitions. Here are several of the ways an impact assessment will help guide the facilitation of a successful M&A on the people side of things.

- Identifies all organizational units, departments, and job roles being impacted

- Identifies HOW each of those organizational groups is being impacted

- Helps you determine the level of training needed for groups

- Guides the types of awareness communications needed for various impacted groups

- Tells you where you need change agents to help with change support

- Identifies where you’re likely to get the most resistance to the change

- Tells you what types of job role guides and documentation are needed

- Identifies all the different types of changes happening due to the M&A (culture, process, system, organizational structure, etc.)

The impact assessment for change management mergers and acquisitions activities is one of the first things you’ll do to manage the change.

The OCMS Portal Change Impacts Assessment Tool makes it easy to wrap your head about the changes and facilitates reporting for change management during mergers and acquisitions.

M&A Change Management Steps for an Impact Assessment

- Learn About the Changes: Meet with the appropriate leadership to fully understand all the changes happening during the merger or acquisition in detail.

- Request Documentation: Request documentation such as new charters, mission statements, process flows, and other details that will help you identify what each impacted group needs to do to successfully transition.

- Identify the Impacted Groups: Reviewing the information you gathered from meetings and documentation, identify all impacted groups in all impacted organizations. It’s best if you enter this information into an impact assessment template so you can easily generate reports and track your activities.

- Categorize the Type & Severity of the Changes: For each change that is happening, identify the type(s) of change (culture, system, process, etc.). For each impacted group, identify the severity level of the change, which will help you prioritize your change management engagement.

- Interview Impacted Group Managers & Key Stakeholders: To ensure you’ve accurately captured the changes and severity level of each one, interview the managers and key stakeholders of impacted groups for their input. Update your impact assessment accordingly.

- Socialize Your M&A Change Management Impact Assessment: Print out reporting from your change management impact assessment template and socialize your assessment with project leads and key sponsors and leadership.

- Finalize Your Change Management M&A Assessment: Update your change impact assessment with the input you’ve received and finalize your finding so you can move on to other change management mergers and acquisitions activities.

Are you looking for change management in mergers and acquisitions PDF reports? Our Change Impact Assessment Template has automated analytics on your organization’s impacts that export to PDF.

How to Assess Employee Readiness Using Change Management During Mergers and Acquisitions

Another important type of assessment you need to conduct for effective management of change during merger and acquisition is an organizational readiness assessment.

How ready are the staff of the impacted organizations for the transition? Do they have clarity on exactly how their position will be impacted? Do they know what new processes, culture, and/or procedures need to be adopted once the merger or acquisition is completed?

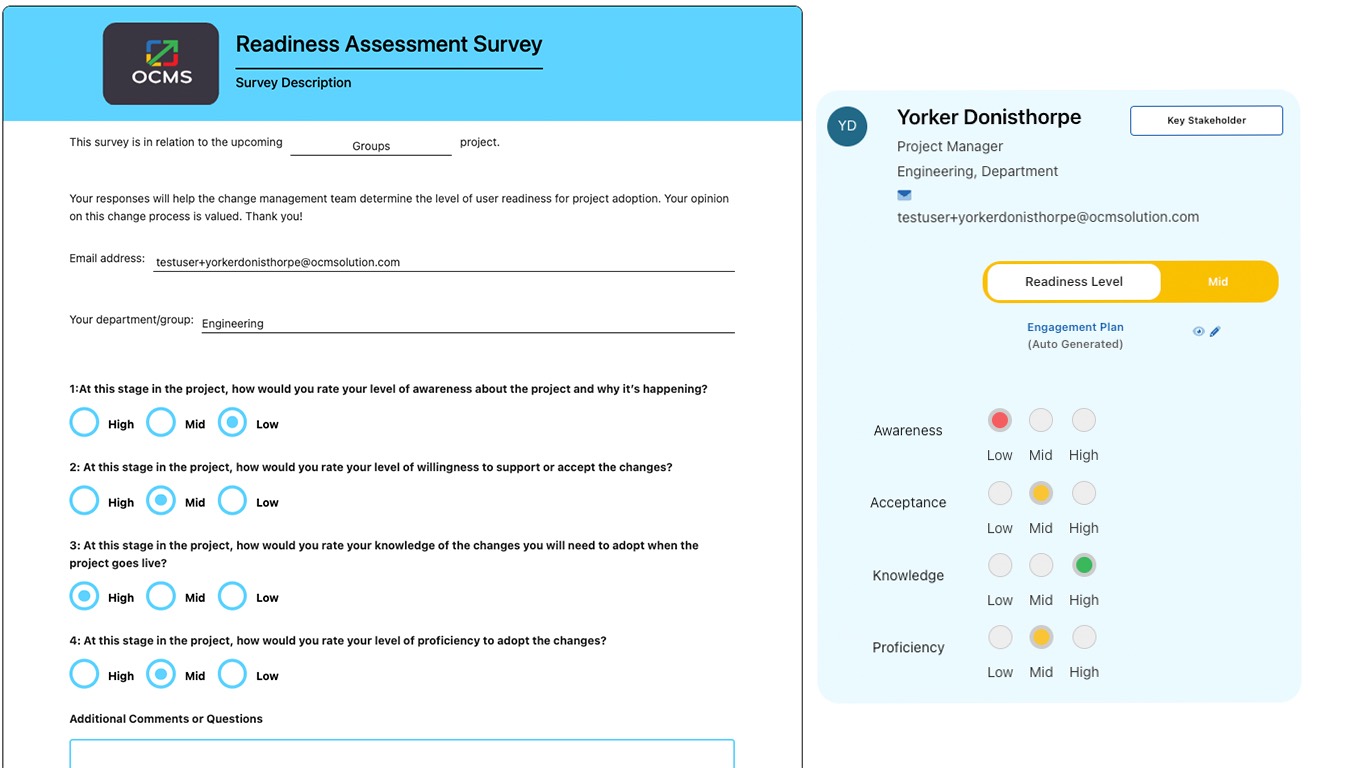

The readiness assessment is performed at different points in an M&A project so you can track progress on employee readiness for the change.

What are some of the M&A change management readiness KPI’s you need to collect?

- Awareness level of the change

- Level of support for the change

- Level of knowledge about the new processes/culture/systems

- Proficiency in the new processes/culture/systems

- Capacity for absorbing the necessary information and training

- The current culture of the group that needs to be transitioned to a new culture

How do you capture those KPI’s?

You can capture the readiness information for your M&A change readiness assessment in a few different ways:

- Surveys to the employees and/or their managers and leadership

- Workshops (in-person or virtual) with impacted groups

- Observations from interacting with the group

- Feedback from sponsored, managers, and change champions

- Training scores for knowledge of a new system and/or proficiency level

Example of an Organizational Readiness Assessment Survey in the OCMS Portal Readiness Assessment Tool

Final Words on Effective Management of Change During Merger and Acquisition

Change management in mergers and acquisitions is a critical component to ensure employees and other impacted stakeholders can transition successfully and productively.

Because the number of changes is usually quite high during M&A, the importance of change management is magnified. Through effective change management practices, you can mitigate negative impacts on employees throughout a transition and increase their buy-in, support, and engagement in the newly transformed organization.

OCMS Portal Business Impact Assessment Tool

Change Management Mergers and Acquisitions FAQs

Change management is an approach and set of tactics used to guide people through a change. Those people are called “stakeholders” and they would include any internal or external groups being impacted by the change. M&A change management is when change management is applied to facilitate the transition caused by a merger or acquisition.

You manage changes in a merger by implementing a change management framework that focuses on preparing employees for the transitions they’re about to go through. Some of the key components of managing M&A change are:

Mergers and acquisitions are one of the types of transformations that involve a lot of things that are changing. Roles and responsibilities, corporate culture, processes, systems, policies, and more can be changed during M&A. Because the number of changes is usually quite high during M&A, the importance of change management is magnified. Through effective change management practices, you can mitigate negative impacts on employees and increase their buy-in, support, and engagement in the newly transformed organization.

According to a survey by McKinsey, organizational problems like failure to adopt a new corporate culture or changed operating models are responsible for nearly 50% of the failure when mergers don’t meet projections. Change management before acquisition helps prepare everyone for the changes to come so there is less apprehension and resistance. Change management after acquisition helps everyone to adapt to their new normal and successfully transition to the new corporate culture, systems, and other changes. External image sources:What is change management M&A?

How do you manage changes in a merger?

• Assessing organizational group & role impacts

• Assessing organizational readiness for the transition

• Communicating the changes with impacted employees

• Training and coaching as needed to help employees learn the new processes, systems, culture, policies, etc.

• Providing support and change management after acquisition or merger to ensure everyone adapts successfully to the new environment How do mergers and acquisitions relate to organizational change?

What is the importance of change management in mergers and acquisitions?

Note: Content on OCM Solution's ocmsolution.com website is protected by copyright. Should you have any questions or comments regarding this OCM Solutions page, please reach out to Ogbe Airiodion (Change Management Lead) or the OCM Solutions Team today. OCM Solution was previously known as Airiodion Global Services (AGS).